Understanding 3x etfs.

Inverse gold etf 3x.

The funds use futures contracts to gain exposure and essentially provide a synthetic short position in gold.

Find the latest velocityshares 3x inverse gold dgld stock quote history news and other vital information to help you with your stock trading and investing.

Exchanges that are currently tracked by etf database.

The 1 year performance numbers in this story are as of.

Plenty of commodity exchange traded funds etfs are on the market today including broad commodity funds as well as etfs that track specific assets like energy metals and materials.

See press release for details.

The notes seek returns that are 3x the returns of the s p gsci.

Inverse short gold etfs seek to provide the opposite daily or monthly return of gold prices.

For instance there may be a 3x inverse gold etf which will generate a profit of 6 percent in the event of gold prices going down by 2 percent that is returns are multiplied by the leverage factor of 3x and are in opposite direction.

These notes have been delisted and further issuance has been suspended.

The five inverse gold products gained between 1 5 and 11 28 for the day.

The most heavily traded leveraged gold etf based on its 3 month average daily volume is the direxion daily gold miners bull 2x shares.

Here s wednesday s performance chart including all gold etf and etn products sorted by single day return.

Velocityshares 3x inverse gold etn metals dgld velocityshares 3x inverse gold etn.

Velocityshares 3x inverse gold etn is an exchange traded note issued in the usa.

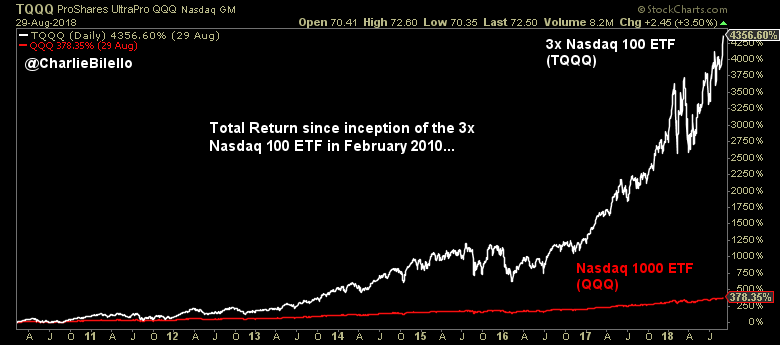

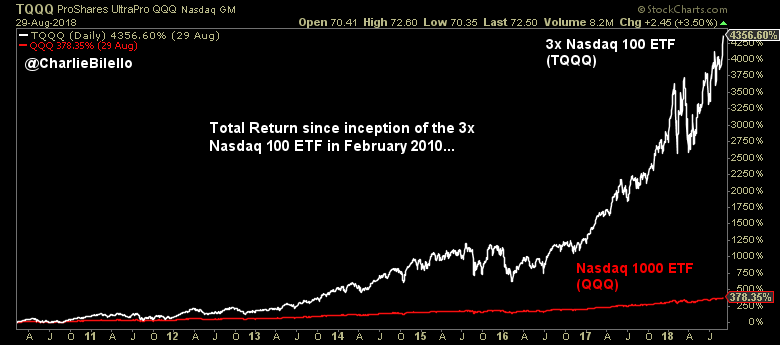

As with other leveraged etfs 3x etfs track a wide variety of asset classes such as stocks bonds and commodity futures the difference is that 3x etfs apply even greater.

In addition to expense ratio and issuer information this table displays platforms that offer commission free trading for certain etfs.

The level of magnification is included in their descriptions and is generally 1x 2x or 3x.